Greek Prime Minister Alexis Tsipras. Photographer: Kostas Tsironis/Bloomberg

by Jenny Paris

Euro-area finance ministers will meet for the third time in a week on Wednesday to try and secure an agreement to avert a default in Greece......

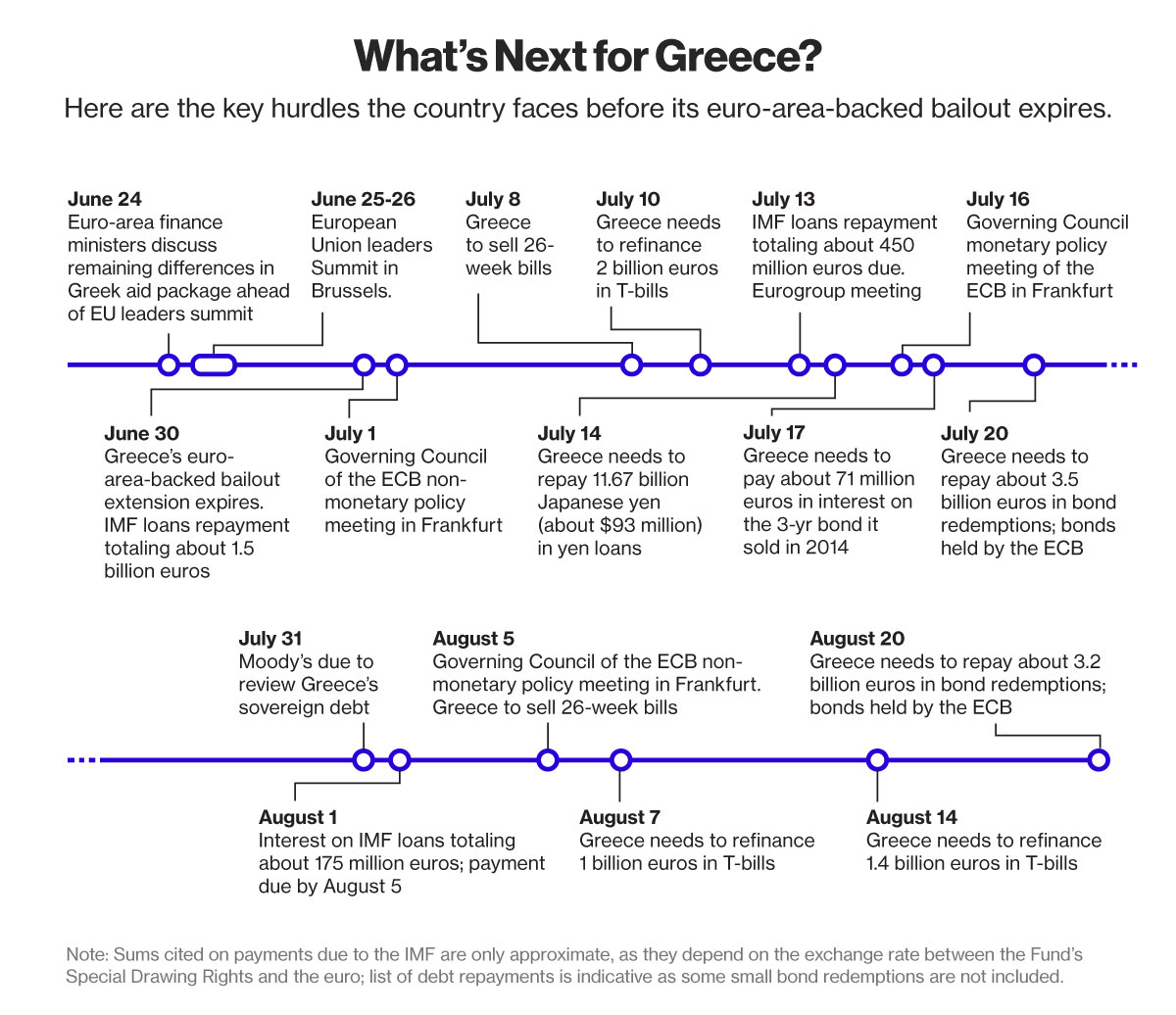

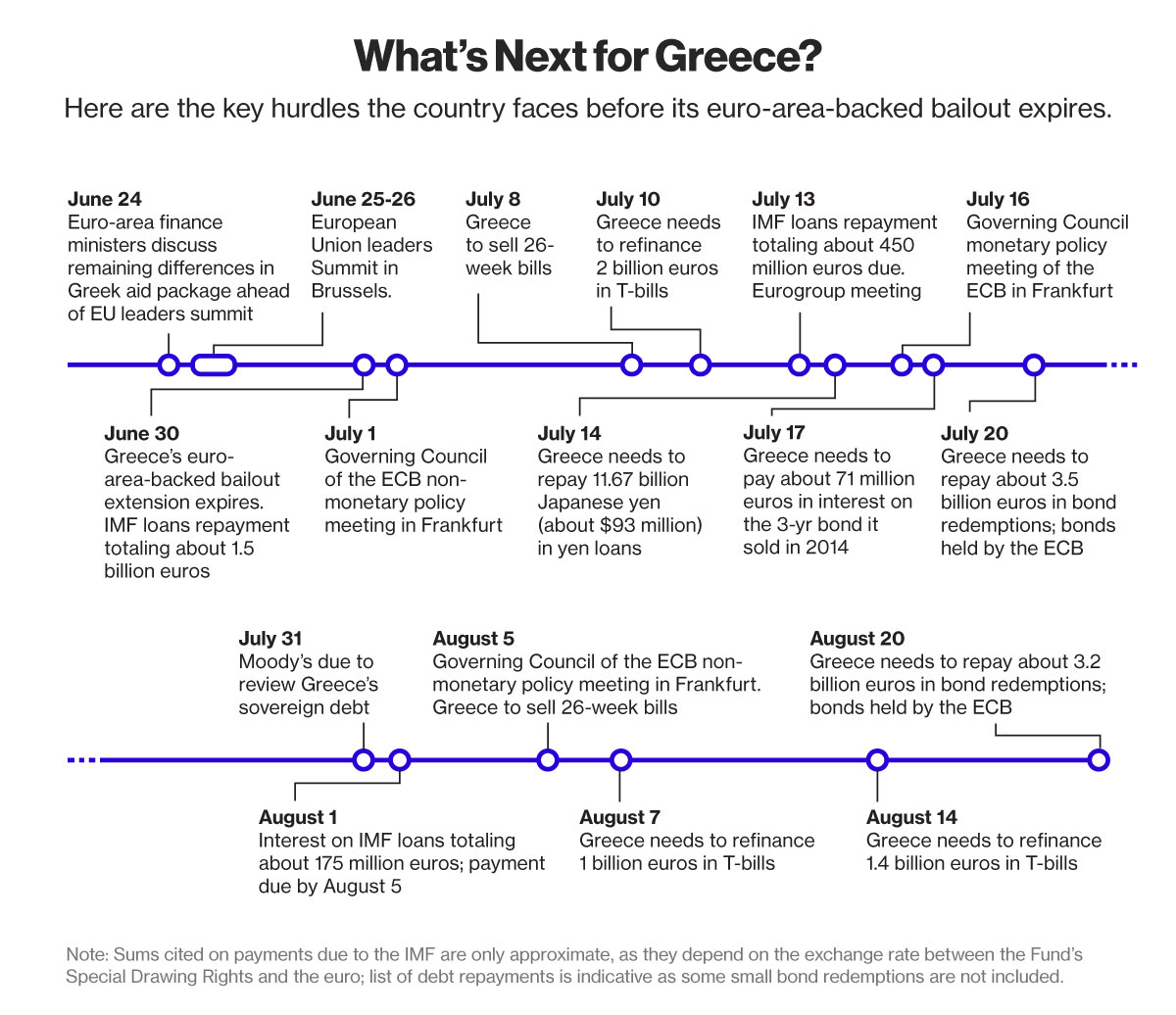

With a week to go before the country’s bailout expires, a deal appeared within reach after Greek Prime Minister Alexis Tsipras signaled he was ready to end a bitter five-month standoff and reach agreement with creditors to unlock aid. While hurdles remain -- including votes in the German and Greek parliaments, and figuring out how to pay the International Monetary Fund -- analysts say a solution will be found.

“We have now seen enough progress for the finishing line to have become visible,” Erik Nielsen, an Unicredit SpA economist in London, wrote in a note to clients. “Failure from here is difficult to envisage. This means that various liquidity measures will be employed, as needed, until it’s all signed off - and the risk of arrears has significantly declined.”

Tsipras will fly into Brussels Wednesday to meet with the heads of the European Central Bank, Mario Draghi, the International Monetary Fund, Christine Lagarde, the European Commission, Jean-Claude Juncker, and two top European Union officials to discuss further steps, an EU official said.

Marathon Talks

After a day of marathon talks Monday, the Greek leader will then meet again with fellow EU leaders later this week. Officials said this week his government is finally getting serious about striking a deal after submitting a set of reform measures that began to converge with the terms demanded by creditors. Still, officials warned that more work lies ahead as Tsipras races to secure backing both at home and abroad.

“I am absolutely convinced that in a few days an agreement will be reached,” Spanish Prime Minister Mariano Rajoy said on Tuesday. “The goal is that Greece remains in the euro, so the amounts remaining from the second program can be drawn down.”

The proposals include steps to eliminate early retirement options, raise the sales tax, increase taxes that middle- and high-income earners pay and introduce a new levy for companies with annual net income of more than 500,000 euros ($568,000).

Hard Work

Greek negotiating work continued at a technical level on Tuesday ahead of the finance ministers’ talks that are due to start at 7 p.m. in Brussels on Wednesday. If an agreement is reached at the ministers’ level, euro-area leaders could sign off on a deal at a two-day summit starting on Thursday.

Hopes that a deal is imminent sent Greek assets rallying for the second day this week. The Athens Stock Exchange Index closed 6.1 percent higher on Tuesday, after surging 9 percent on Monday. The yield on the two-year bond fell 329 basis points to 21 percent.

A lot remains to be done, with Lagarde saying after Monday’s talks that the package, while comprehensive, “lacks specificity.”

Greece will need to commit to so-called prior actions to unlock funds, according to European Commission spokesman Margaritis Schinas. “We would like these prior actions to be spelled out in the form of a list, of a complete list, of deliverables,” Schinas told reporters Tuesday in Brussels.

German Vote

Even if a deal is secured, it may come too late for Greece to receive aid in time for a 1.5 billion-euro payment to the International Monetary Fund due on June 30. Germany has insisted that Greek lawmakers take the first step by passing economic policy changes before the German lower house of parliament will agree to a revised aid deal.

Germany’s lower house of parliament could vote June 29 or June 30 on any rescue agreement, provided Greek lawmakers pave the way by approving bailout measures over the weekend, a German parliament official said.

“The institutions have made it clear that they will not disburse any money before the Greek parliament approves the needed legislation and implements prior actions,” Athanasios Vamvakidis, a strategist at Bank of America Merrill Lynch, wrote in a client note. “These requirements make it unlikely that Greece will receive new official loans by June 30.”

Political Cost

The potential agreement could come at a political cost for Tsipras as it runs against his government’s pledge to end austerity. Some of the more radical and populist lawmakers in his ruling coalition, whose members range from Maoists to far-right nationalists, came out in opposition to the proposals on Tuesday.

“Personally, I cannot support such an agreement that is contrary to our election promises,” said Dimitris Kodelas, a lawmaker for the governing Syriza party who is part of a fringe faction associated with former Maoists. “I do not care about the consequences of my decision.”

Source:http://www.bloomberg.com/europe

With a week to go before the country’s bailout expires, a deal appeared within reach after Greek Prime Minister Alexis Tsipras signaled he was ready to end a bitter five-month standoff and reach agreement with creditors to unlock aid. While hurdles remain -- including votes in the German and Greek parliaments, and figuring out how to pay the International Monetary Fund -- analysts say a solution will be found.

“We have now seen enough progress for the finishing line to have become visible,” Erik Nielsen, an Unicredit SpA economist in London, wrote in a note to clients. “Failure from here is difficult to envisage. This means that various liquidity measures will be employed, as needed, until it’s all signed off - and the risk of arrears has significantly declined.”

Tsipras will fly into Brussels Wednesday to meet with the heads of the European Central Bank, Mario Draghi, the International Monetary Fund, Christine Lagarde, the European Commission, Jean-Claude Juncker, and two top European Union officials to discuss further steps, an EU official said.

Marathon Talks

After a day of marathon talks Monday, the Greek leader will then meet again with fellow EU leaders later this week. Officials said this week his government is finally getting serious about striking a deal after submitting a set of reform measures that began to converge with the terms demanded by creditors. Still, officials warned that more work lies ahead as Tsipras races to secure backing both at home and abroad.

“I am absolutely convinced that in a few days an agreement will be reached,” Spanish Prime Minister Mariano Rajoy said on Tuesday. “The goal is that Greece remains in the euro, so the amounts remaining from the second program can be drawn down.”

The proposals include steps to eliminate early retirement options, raise the sales tax, increase taxes that middle- and high-income earners pay and introduce a new levy for companies with annual net income of more than 500,000 euros ($568,000).

Hard Work

Greek negotiating work continued at a technical level on Tuesday ahead of the finance ministers’ talks that are due to start at 7 p.m. in Brussels on Wednesday. If an agreement is reached at the ministers’ level, euro-area leaders could sign off on a deal at a two-day summit starting on Thursday.

Hopes that a deal is imminent sent Greek assets rallying for the second day this week. The Athens Stock Exchange Index closed 6.1 percent higher on Tuesday, after surging 9 percent on Monday. The yield on the two-year bond fell 329 basis points to 21 percent.

A lot remains to be done, with Lagarde saying after Monday’s talks that the package, while comprehensive, “lacks specificity.”

Greece will need to commit to so-called prior actions to unlock funds, according to European Commission spokesman Margaritis Schinas. “We would like these prior actions to be spelled out in the form of a list, of a complete list, of deliverables,” Schinas told reporters Tuesday in Brussels.

German Vote

Even if a deal is secured, it may come too late for Greece to receive aid in time for a 1.5 billion-euro payment to the International Monetary Fund due on June 30. Germany has insisted that Greek lawmakers take the first step by passing economic policy changes before the German lower house of parliament will agree to a revised aid deal.

Germany’s lower house of parliament could vote June 29 or June 30 on any rescue agreement, provided Greek lawmakers pave the way by approving bailout measures over the weekend, a German parliament official said.

“The institutions have made it clear that they will not disburse any money before the Greek parliament approves the needed legislation and implements prior actions,” Athanasios Vamvakidis, a strategist at Bank of America Merrill Lynch, wrote in a client note. “These requirements make it unlikely that Greece will receive new official loans by June 30.”

Political Cost

The potential agreement could come at a political cost for Tsipras as it runs against his government’s pledge to end austerity. Some of the more radical and populist lawmakers in his ruling coalition, whose members range from Maoists to far-right nationalists, came out in opposition to the proposals on Tuesday.

“Personally, I cannot support such an agreement that is contrary to our election promises,” said Dimitris Kodelas, a lawmaker for the governing Syriza party who is part of a fringe faction associated with former Maoists. “I do not care about the consequences of my decision.”

Source:http://www.bloomberg.com/europe