Greece is staggering toward default, and the rest of Europe is taking a hit as well.

Stock

markets sank in Europe following........

a weekend where the European Central

Bank capped its lifeline to Greek banks, and the government in Athens

responded by introducing capital controls.

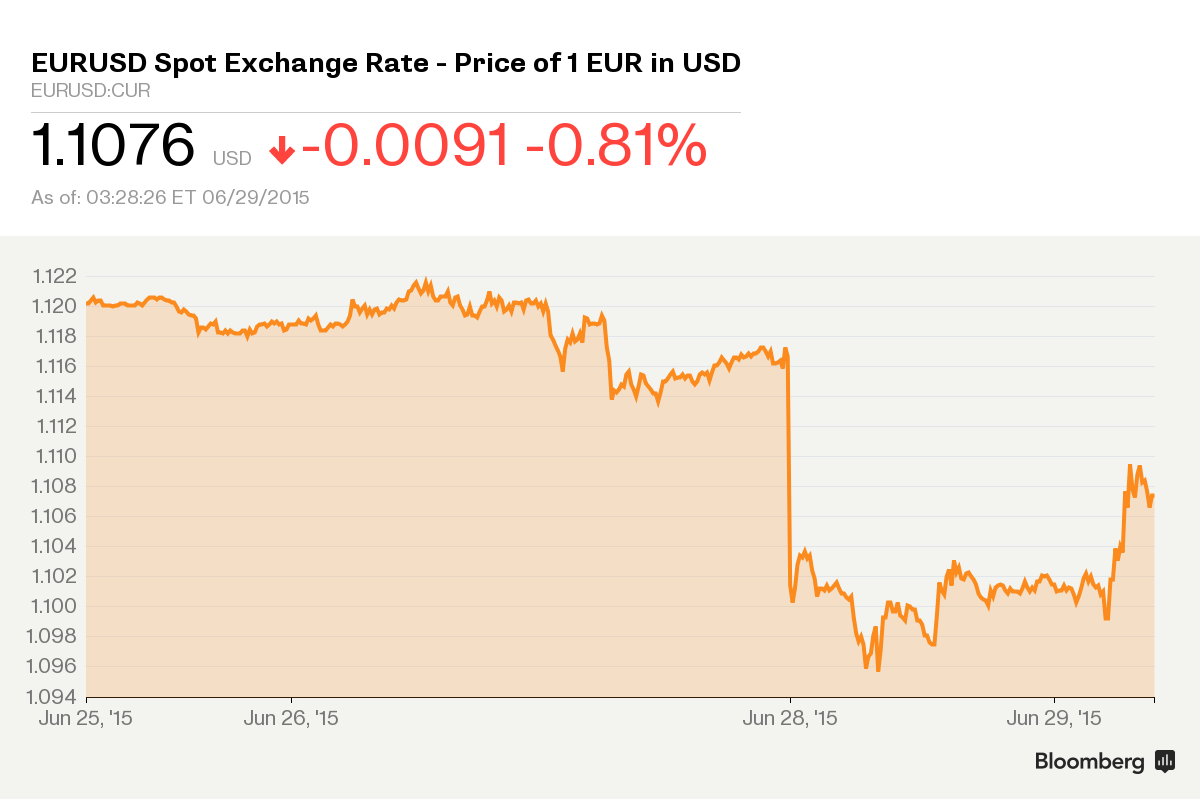

The

euro dropped as much as 2 percent in overnight trading, but has since

recovered some of those losses and is now trading down 0.8 percent.

Equities in the euro area are getting hit hard, with the EuroStoxx 50 Index down over 4.5 percent in early trading.

Peripheral

bonds sold off at the open but have been recovering, with the Italian

10-year yield 16 basis points higher, having traded as much as 57 basis

points wider at the open.

Spanish

10-year yields have followed a similar pattern, with the 49 basis-point

jump at the open now reduced to 15 basis points, leaving the current

yield at 2.256 percent.

Greek bonds plummeted, sending yields higher. The yield on Greek 10-year bonds is 3.7 percentage points higher at 14.6 percent.

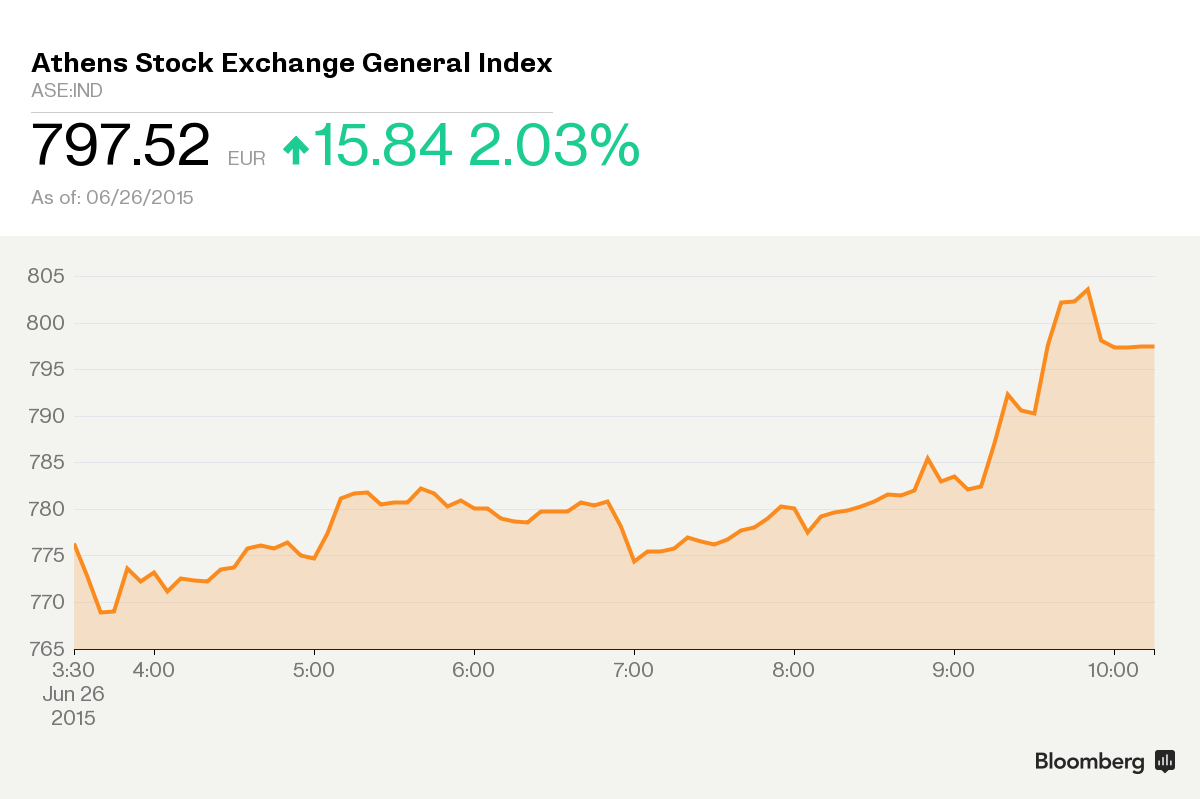

The chart of the Greek stock market will look like this for now, because it's not going to open today, with little indication yet as to when it will.

Source: bloomberg.com